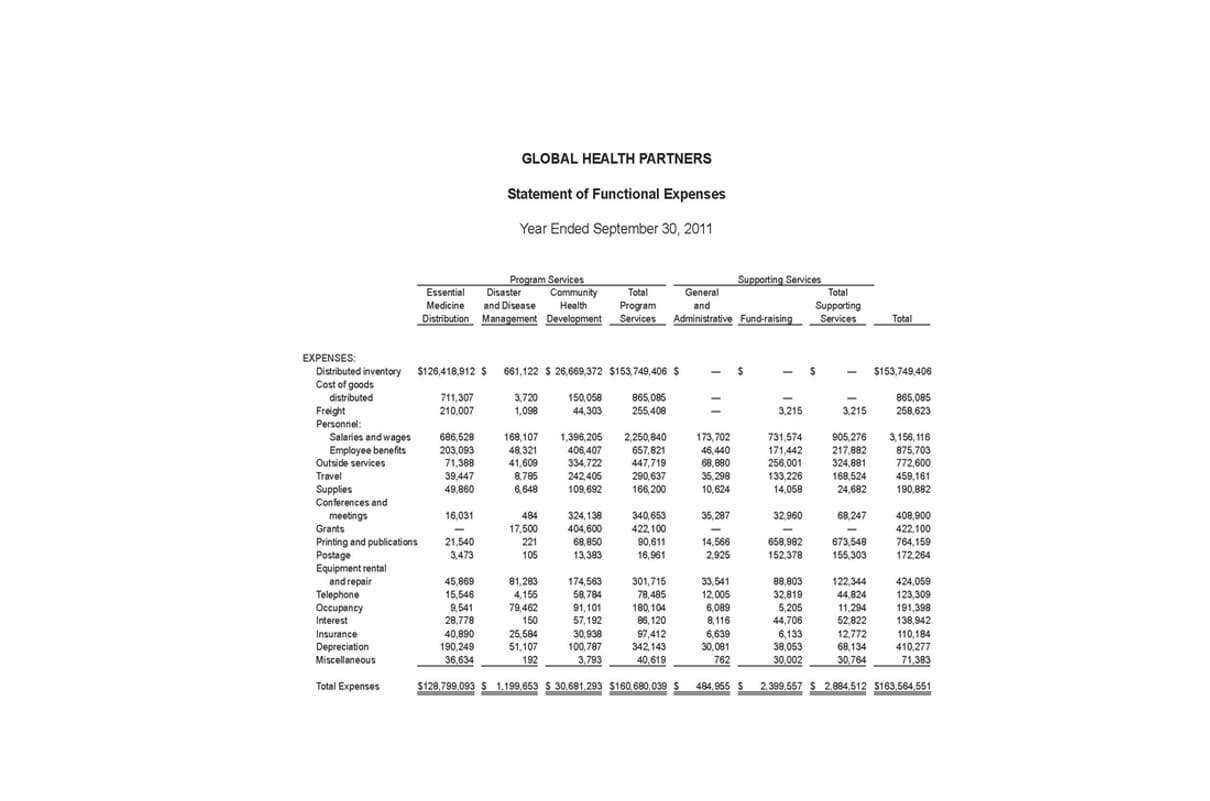

The rate on the first $10,275 of taxable income would be 10%, then 12% on the next $31,500, then 22% on the final $8,225 falling in the third bracket. This is because marginal tax rates only apply to income that falls within that specific bracket. Based on these rates, this hypothetical $50,000 earner owes $6,617, which is an effective tax rate of about 13.2%. One middle bracket was removed and a couple of small changes were made to the middle bracket tax rates. Both last year and this year millionaires are being taxed 1% to 2% more than just a few years ago.

Multiple corporations may file a consolidated return at the federal and some state levels with their common parent. The US tax system allows individuals and entities to choose their tax year. There are restrictions on choice of tax year for some closely held entities. Taxpayers may change their tax year in certain circumstances, and such change may require IRS approval.

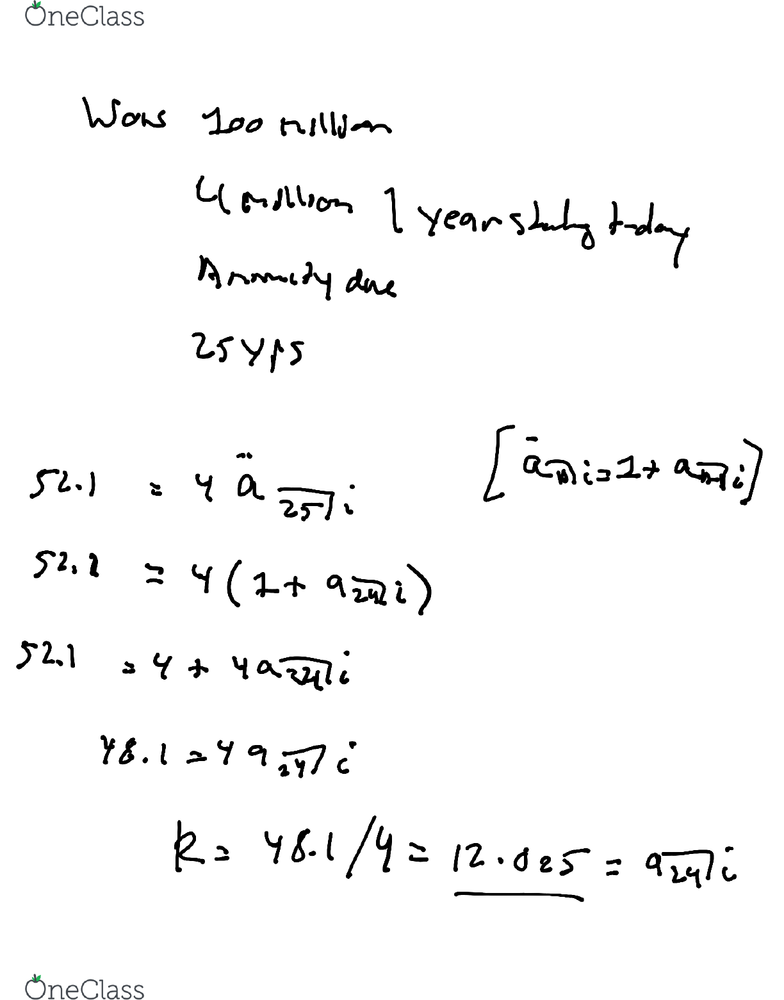

Rates & Brackets (Long-term Capital Gains)

U.S. treaties do not apply to income taxes imposed by the states or political subdivisions, except for the non discrimination provisions that appear in almost every treaty. Also, U.S. treaties generally do not permit U.S. persons from invoking treaty provisions with respect to U.S. taxes, with certain relatively standard exceptions. Income https://www.bookstime.com/ in America is taxed by the federal government, most state governments and many local governments. The federal income tax system is progressive, so the rate of taxation increases as income increases. In lieu of the tax computed using the above rates, the individual AMT may be imposed under a two-tier rate structure of 26% and 28%.

Gross income includes all income earned or received from whatever source. Some income, such as municipal bond interest, is exempt from income tax. For example, if you’re married and filing jointly for 2023 taxes with a taxable income of $95,000, you’d fall under the 22% tax bracket even though a majority of your taxable income ($89,450) falls under the 12% tax bracket.

2024 tax brackets and federal income tax rates

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. That clearly alarms tax experts, including Callas, who served as Speaker Ryan’s chief tax counsel at the time the bill was negotiated and passed. In other words, it’s not just the Moores’ one-time tax at risk in this case.

The IRS Collection Divisions are responsible for most collection activities. Federal income brackets and tax rates for individuals are adjusted annually for inflation. The Internal Revenue Service (IRS) accounts for changes to the CPI[16] and publishes the new rates as “Tax Rate Schedules”.

Medicare contribution tax

For those adjustments to which agreement is not reached, the IRS issues a 30-day letter advising of the adjustment. The taxpayer may appeal this preliminary assessment within 30 days within the IRS. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners. “Income taxes” are levied on wages as well as capital gains, and go to federal and state government general funds.

- However, a provision called tax-benefit recapture means that many high earners have to take extra steps to calculate their state tax liability.

- If you want to compare all of the state tax rates on one page, visit the list of state income taxes.

- Notice, however, the New York income tax brackets for Married Filing Jointly increase from $8,500 to $17,150 (approximately double) at 4%,

and increase from $1,077,550 to $2,155,350 (approximately double) at 6.85% the historical highest tax bracket. - Gross income includes all income earned or received from whatever source.

- State limitations on deductions may differ significantly from federal limitations.

- There is no doubt about it — taxes are by far the single largest expense that most Americans pay every year.

Penalties for filing or paying late are generally based on the amount of tax that should have been paid and the degree of lateness. Penalties for failures related to certain forms are fixed amounts, and vary by form from very small to huge. Business deductions in excess of business income result in losses that may offset other income. In addition, losses may not, in most cases, be deducted in excess of the taxpayer’s amount at risk (generally tax basis in the entity plus share of debt). Taxpayers have rights to appeal any change to tax, and these rights vary by jurisdiction. Tax authorities may not make changes after a certain period of time (generally three or four years from the tax return due date).

Personal deductions

You can never go wrong when you earn an extra stream of income in the stock market, allowing you to take advantage of favorable capital gains rates if you hold your investments over a year. There’s even a chance you’ll us state income tax rates pay no taxes on your gains if your income is under certain limits. You can’t escape taxes, so the best thing you can do is learn how to better manage your taxes and understand how the tax code can work in your favor.

Below, are the brackets and rates that apply to taxable income earned in 2023. The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine your effective tax rate, divide your total tax owed (line 16) on Form 1040 by your total taxable income (line 15). Active-duty pay is taxed like normal income if you are a resident of the state. If you weren’t a full-time New Yorker when you entered the military but were assigned duty in the state, you’re considered a nonresident.

This means that, although you fall under the 22% tax rate, your effective tax rate is about 16.8%, which is the average tax rate of the total taxable income you’re required to pay. These tax rate schedules are provided to help you estimate your federal income tax. Long-term capital gains are taxed using different brackets and rates than ordinary income. Many states, as well as some cities and counties, have their own income taxes. States that have a state income tax require that you file a separate state tax return, as they have their own rules.