(IAS 1.99) If an entity categorises by function, then additional information on the nature of expenses, at least, – depreciation, amortisation and employee benefits expense – must be disclosed. (IAS 1.104) The major exclusive of costs of goods sold, are classified as operating expenses. These represent the resources expended, except for inventory purchases, in generating the revenue for the period. Expenses often are divided into two broad sub classifications selling expenses and administrative expenses. In expense recognition, choice of method (i.e., depreciation method and inventory cost method), as well as estimates (i.e., uncollectible accounts, warranty expenses, assets’ useful life, and salvage value) affect a company’s reported income.

However, if the stock price were to appreciate, then the balance sheet entry would be erroneous. Other comprehensive income would rectify this by adjusting it to the stock’s prevailing market value and stating the difference in the equity section of the balance sheet. The cash flow statement shows how a company generated and spent cash throughout a given timeframe.

Example of Statement of Comprehensive Income

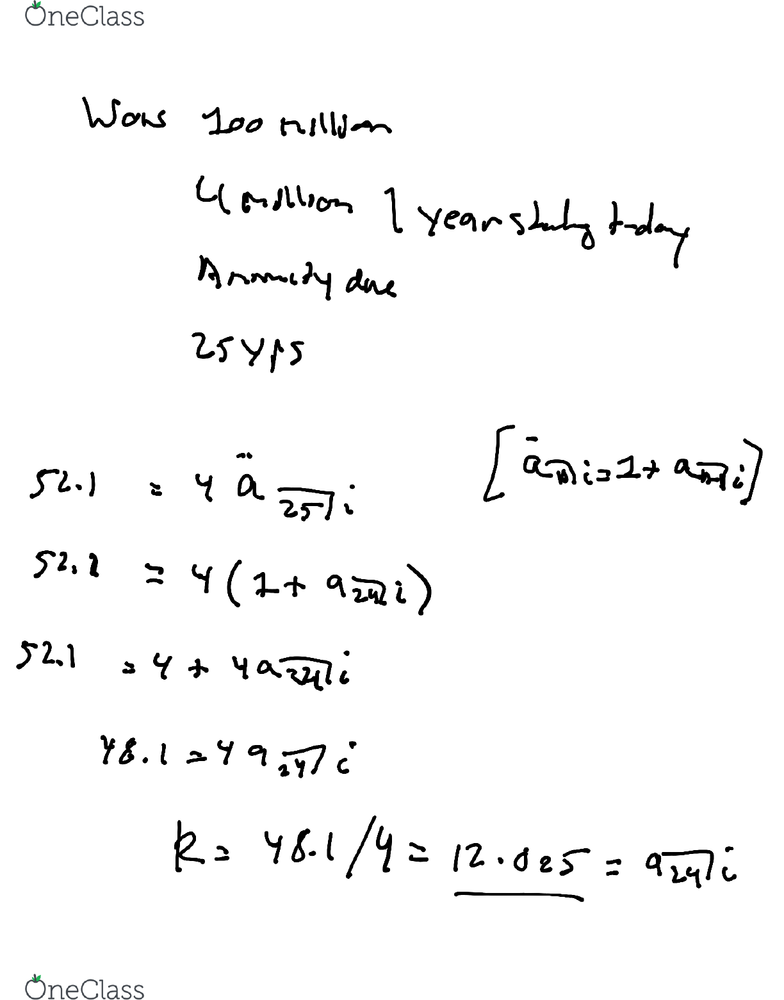

The final step is to deduct taxes, which finally produces the net income for the period measured. To assess a company’s future earnings, it is helpful to separate those prior years’ items of income and expense that are likely to continue in the future from those items that are less likely to continue. A cash flow statement can help you to manage your finances and avoid the worst surprises. The formulas in our income statement template will do most of the calculations for you. This gives you the company’s profit or loss before taxation figure. There is no separate line on the income statement where you note the value of these expenses.

FreshBooks provides free template income statements that are pre-formatted for your needs. All you need to do is fill in the empty fields with the numbers you’ve calculated. Creditors can see how much skin investors have in the company and investors can see the potential of the company assets and future earnings and profits if these assets were actually sold and the gains were realized. As you can see, the net income is carried down and adjusted for the events that haven’t occurred yet. This gives investors and creditors a good idea of what the company’s assets and net assets are truly worth.

As well as net income, comprehensive income includes unrealized gains and losses on available-for-sale investments. It also includes cash flow hedges, which can change in value depending on the securities’ market value, and debt securities transferred from ‘available for sale’ to ‘held to maturity’, which may also incur unrealized gains or losses. Gains or losses can also be incurred from foreign currency translation adjustments and in pensions and/or post-retirement benefit plans. An income statement is a core financial statement that shows you the company’s revenues, costs and expenses, net income or loss, and other comprehensive income for a period of time used in accounting. An income statement is used alongside the balance sheet and cash flow statement to paint a clear picture of a company’s financial health. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows.

What’s the Difference Between a Balance Sheet and Income Statement?

Companies can choose whichever format best suits their reporting needs. Smaller privately held companies tend to use the simpler single- step format, while publicly traded companies tend to use the multiple-step format. When condensed formats are used, they are supplemented by extensive disclosures in the notes to the financial statements and cross-referenced to the respective line items in the statement of income. The SCI, as well as the income statement, are financial reports that investors are interested in evaluating before they decide to invest in a company. The statements show the earnings per share or the net profit and how it’s distributed across the outstanding shares. The higher the earnings for each share, the more profitable it is to invest in that business.

‘Continuing operations’ and ‘Discontinued operations’ profit rows only print where there is relevant data in the Discontinued operations note. For Interim Reports, as the comparative period covers two different periods , the interim performance and the prior position balances are ignored. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. At the end of the period, it has an unrealized loss of $500 on its derivative contracts.

Contents

Under both IFRS and US GAAP, the income statement reports separately the effect of the disposal of a component operation as a “discontinued” operation. Once you have the final net profit or loss figure for the period, you can carry it forward to your cash flow statement for the same period. Deduct the cost of sales from turnover to calculate the gross profit of the company for the period.

Income Statement: Definition, Uses, Example – Business Insider

Income Statement: Definition, Uses, Example.

Posted: Wed, 27 Jul 2022 07:00:00 GMT [source]

To achieve the core principle, the standard describes the application of five steps in recognizing revenue. The standard also specifies the treatment of some related contract costs and disclosure requirements. Remember to follow all relevant accounting rules and standards when you prepare it.

We strive to empower readers with the most factual and reliable climate finance information possible to help them make informed decisions. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others.

- Non-operating gains or losses and expenses follow on the next two line items.

- It means, as Simply Business put it, “the total sales made by a business a certain period”.

- A single-step income statement treats the cost of goods sold as expenses.

- To calculate total income, subtract operating expenses from gross profit.

- This in turn affects the quality of earnings reported in an income statement.

It also includes a column that you must use to enter the amounts of any line items for the preceding period too. To speed up the process and help you out, we’ve put together a free template you can use to create an income statement. The next line item is Tax effect, followed by a subtotal line for Other comprehensive income , net. Following net income are four separate line items for Basic net income per share, Diluted net income per share, Shares used in computing basic net income per share, and Shares used in computing diluted net income per share. The following line subtracts Total operating expenses from Gross Profit.

Other expenses

The reason this ratio is so crucial for https://1investing.in/ before making an investment is that it helps them decide which firm to invest in. Interest Coverage RatiosThe interest coverage ratio indicates how many times a company’s current earnings before interest and taxes can be used to pay interest on its outstanding debt. It can be used to determine a company’s liquidity position by evaluating how easily it can pay interest on its outstanding debt. Any gains/losses due to the change in valuation are not included in the Income Statement but are reflected in the Statement of Comprehensive Income. Please be advised that you will be liable for damages (including costs and attorneys’ fees) if you materially misrepresent that a product or activity is infringing your copyrights.

What is the password to open Annual Information Statement (AIS) after downloading – Economic Times

What is the password to open Annual Information Statement (AIS) after downloading.

Posted: Wed, 20 Jul 2022 07:00:00 GMT [source]

If you need to prepare a balance sheet, use our balance sheet template. For companies not in the lending business, interest income and interest expense are netted and shown in the Other expenses section of an income statement, between Operating income and Net income before taxes. Net income flows to retained earnings in the shareholders’ equity section of the balance sheet.

Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. Consider enrolling in Financial Accounting—one of three courses comprising our Credential of Readiness program—which can teach you the key financial topics you need to understand business performance and potential. It helps management accountants keep checks over the organization’s cost and revenue and helps in laying down the strategy for optimization of cost and maximization of revenue.

Stakeholders can use the information about costs and expenses to understand why the company performed the way it did. An income statement will tell you how much money your company has made over a period. There are lots of other useful things it can tell you too, but unfortunately, people often view it negatively. Metrics include several profitability ratios, including the rate of return on investment . The DuPont ratio multiplies net profitability, asset turnover, and financial leverage to compute return on equity . Net income, called the bottom line, is included in both income statement formats.

All have in-depth knowledge and experience in various aspects of payment scheme technology and the accountancy rules applicable to each. The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand. This means that the amounts presented on the report include only those that occurred within the given period. For example, the SCI in Figure 1 is described as “for the year ended December 13,Y.

Other comprehensive income are manual numbers, due to complex reserves and non-controlling interests movements, and they are balance checked in the Statement of changes in equity. Trial Balance accounts and Adjustments for other comprehensive income are allocated to reserves (EQR## and for non-controlling interests reserves EQMRE). Small larger companies like banks, insurance companies, and other financial institutions have large portfolios of investments. These investments could include treasury bond and bills, equity stakes in other companies, term finance certificates, etc. At the end of the financial period, return outwards account is concurrently closed down to trading account as afore indicated above.

The statement of comprehensive income contains those revenue and expense items that have not yet been realized. It accompanies an organization’s income statement, and is intended to present a more complete picture of the financial results of a business. It is typically presented after the income statement within the financial statements package, and sometimes on the same page as the income statement.

It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. A P&L, which stands for profit and loss, indicates how the revenues are transformed into net profit. Other comprehensive income includes many adjustments that haven’t been realized yet. These are events that have occurred but haven’t been monetarily recorded in the accounting system because they haven’t been earned or incurred. You can think of it like adjusting the balance sheet accounts to their fair value. Our first step is to construct the normal, single-step income statement.

The statement for Toulon Ltd. is an example of reporting expenses by nature. The gain or loss is realized and reported on the income statement only when it is sold. For instance, Company A has many treasury bills and the yields for those have decreased during the period.